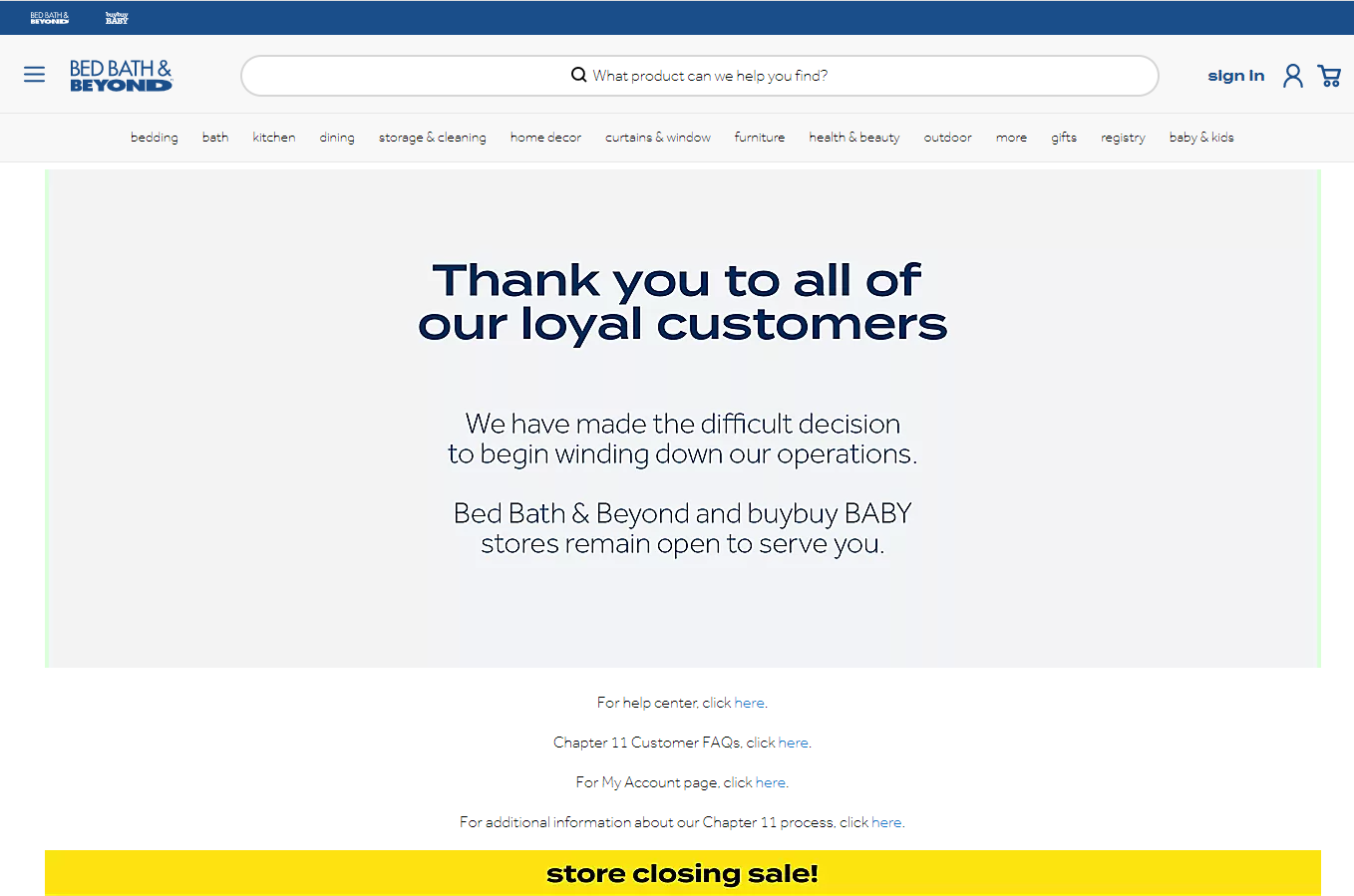

After a years-long battle to stay afloat, the deteriorating home goods merchant Bed Bath & Beyond filed for bankruptcy on April 23. How will retailers capitalize on the houseware merchant’s bankruptcy filing?

Bed Bath & Beyond has experienced years of dwindling sales. Most recently, the merchant lost 33% in digital sales in 2022 compared with a year earlier, according to Digital Commerce 360 data.

There is not much ground to be gained by competitors. By the end of its tenure, the ailing home goods merchant accounted for 1.4% of overall houseware/home furnishings in the U.S. market in 2022, according to Digital Commerce 360 analysis of U.S. Department of Commerce data.

Digital sales for the housewares and home furnishings category decreased in 2022. Consumers spent less time and money on home improvement projects. Instead, consumers allocated funds to pre-pandemic activities like dining out and traveling. Including Bed Bath & Beyond, the U.S. Top 1000 Digital Commerce 360 retailers accounted for 29.9% of housewares/home furnishings category sales in 2022. That is down from 32.1% in 2021. Notably, without Bed Bath & Beyond, web sales for the category would have declined 4.1% in 2022.

Amazon continues to dominate home goods category

Mass merchants like Amazon.com Inc. (No. 1 in Digital Commerce 360’s Top 1000 retailer rankings), Walmart Inc. and Target Corp. (No. 5) have also experienced a slowdown in ecommerce sales. Amazon still holds the majority of the home goods category market share with 88.47% in 2022. That is down compared with 86.13% in 2021, according to market research company YipitData.

Walmart (No. 2) also experienced a decline. Its market share accounted for 7.27% in 2022, compared with 8.58% in 2021. And Target Inc. also dropped in 2022 to 4.27%, compared with 5.29% in 2021.

A long time coming

Bed Bath & Beyond never quite caught on to ecommerce, says Rich DePencier, area managing partner and chief marketing officer of Chief Outsiders, a management consulting services company.

The retailer didn’t experience the pandemic-induced burst of ecommerce growth other merchants did. Of the top five merchants in the houseware/home furnishings category, Bed Bath & Beyond was the only retailer to have less than 10% 3-year CAGR, according to Digital Commerce 360 analysis.

Where Bed Bath & Beyond shoppers will shop instead

When asked where Bed Bath & Beyond shoppers will shop instead:

- Amazon (68%)

- Target (58%)

- Walmart (48%)

- Home Goods (34%)

- At Home (12%)

- Macy’s (10%)

- Wayfair (5%)

- Crate & Barrel (3%)

- Williams-Sonoma (3%)

- Overstock (2%)

- Nordstrom (2%), according to Numerator, a consumer insights and analytics company survey of 500 verified Bed Bath & Beyond shoppers on April 24.

The opportunity lies in providing the shopping “experience” that Bed Bath & Beyond offered consumers, DePencier says.

“Retailers that are willing to invest in becoming more of a solution for consumers stand to benefit,” he says. That entails connecting the online and in-store experience of shopping for “big cultural moments.” These moments include weddings, babies, and college dorm room shopping.

Wayfair is opening stores in the U.S. to give consumers the option to see in-person what they might buy online. In 2022, IKEA invested $3 billion to turn stores across the U.S. and Europe into delivery hubs and support its ecommerce sales. In April 2023, IKEA invested $2.2 billion to expand storefronts and fulfillment networks throughout the U.S.

“Merchants like Wayfair are trying to create that in store experience. It’s just like how an IKEA has a warehouse right next to the store. You can pick the product on your way out,” says Gopi Polavarapu, senior vice president and general manager of Kore.ai, an artificial intelligence customer experience software vendor. “Especially when it comes to three or four day delivery commitments. It’s impossible to commit to those [timeframes] because they don’t have warehouses in every market.” That’s where locally positioned storefronts come in handy to provide last mile delivery, he says.

Bed Bath & Beyond was too slow to adopt new technology

Before the pandemic, Bed Bath & Beyond had a game plan in place to use technology like QR codes to help consumers shop in-store. Then the pandemic hit and the merchant didn’t adjust its ecommerce side of the business, Polavarapu says.

Polavarapu previously worked at software vendor Zebra Technologies, which sells electronic sensors and industrial scanners. The software and device vendor met with Bed Bath & Beyond in 2019 to introduce these devices to modernize in-store shopping experience, he says. “The plan included placing QR codes [on merchandise] to help shoppers” find what they needed in store, Polavarapu says.

“But when it came to digital ecommerce, they were much slower in adopting technology,” he says. “They tried to save as much [money] as they could rather than modernizing their entire operations.”

Bed Bath & Beyond filed for Chapter 11 bankruptcy on April 23. It plans to liquidate inventory and go out of business.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News.

Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite